The New Owners Behind the Curtain

You won’t find their names on jerseys or championship banners, but private equity firms are now some of the most powerful players in professional sports.

In the past three years, groups like Arctos Sports Partners, Silver Lake, and RedBird Capital have collectively invested over $15 billion across leagues and franchises — from NBA teams like the Golden State Warriors and Sacramento Kings, to MLB’s Los Angeles Dodgers, and even AC Milan in European football.

Their growing presence marks a quiet but significant shift: sports are no longer just about team pride or media rights — they’re increasingly viewed as long-term financial assets.

What was once a passion-driven ownership model is becoming a diversified investment portfolio.

The real owners of pro sports are not in the locker room — they’re in the boardroom. (Original)

Why Private Equity Is Betting on Sports

The logic is simple: sports generate predictable revenue, enjoy fan loyalty that’s nearly recession-proof, and have scarce supply — there are only 32 NFL teams, and they don’t come up for sale often.

That scarcity makes sports franchises “trophy assets” — stable and appreciating. According to Sportico’s 2025 valuations, the average NBA team is now worth $3.6 billion, up 19% year-over-year. The NFL’s average valuation hit $5.3 billion, even as some teams struggle on the field.

Private equity funds see this as a reliable store of value — one with global expansion potential, media leverage, and long-term upside through tech integration and fan monetization.

The trophy asset meets the trophy investor. (Original)

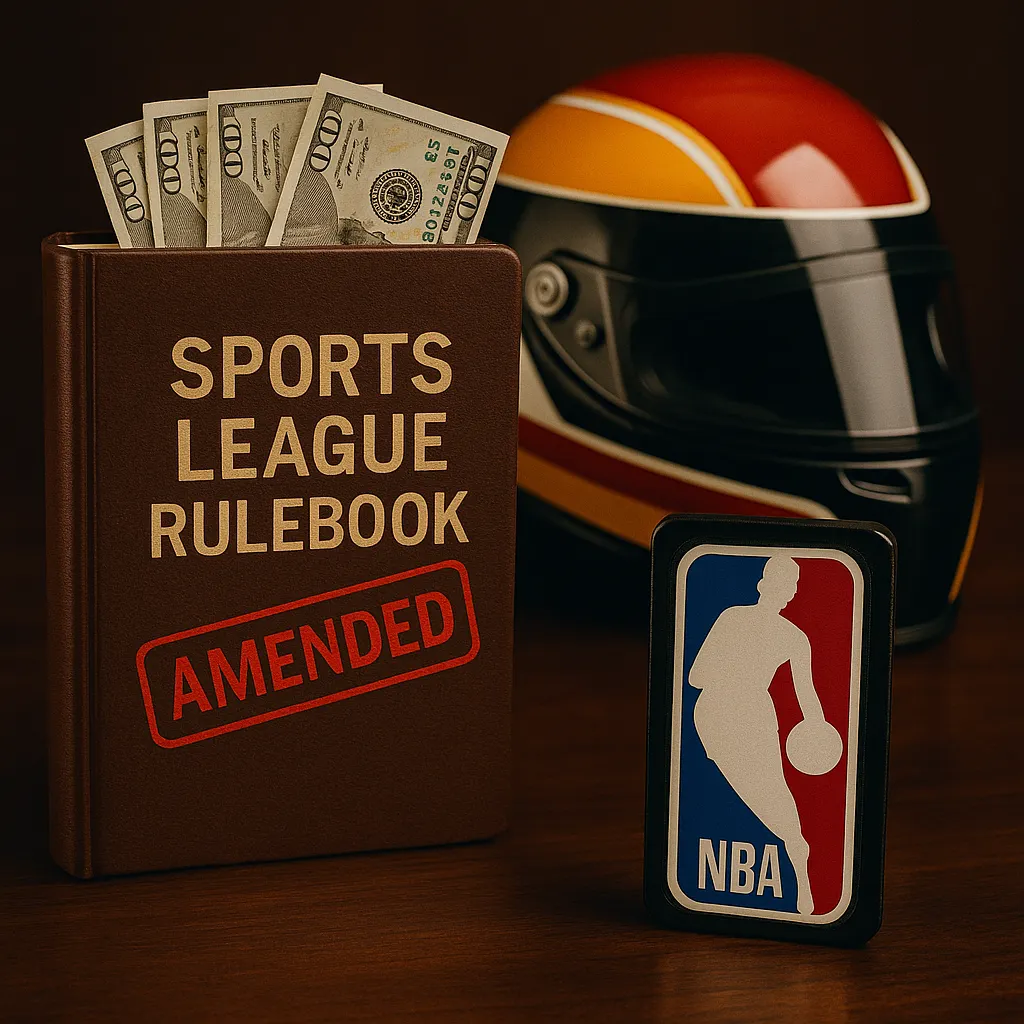

Changing the Rules of Ownership

Until recently, most leagues blocked institutional investors. But in 2021, the NBA approved a new policy allowing private equity firms to buy up to 20% of a single franchise, and up to 30% total across multiple teams.

This paved the way for Arctos to invest in the Warriors, Kings, and 76ers, while Dyal HomeCourt Partners joined the Phoenix Suns ownership group.

MLB followed suit in 2022, launching a league-controlled investment fund called MLB Investment Group, which now holds stakes in teams like the Chicago Cubs and San Francisco Giants, alongside institutional partners.

In European football, RedBird Capital acquired AC Milan for $1.2 billion in 2022, and Silver Lake owns a 14% stake in City Football Group, which controls Manchester City and 11 other clubs globally.

Even Formula 1 has gone corporate. Since Liberty Media acquired the league, its commercial footprint has exploded — thanks to U.S. Grand Prix expansion, streaming deals, and Wall Street muscle behind the scenes.

The rules of ownership are evolving — and private equity is writing the next chapter. (Original)

The Upside (and the Unease)

There are clear benefits. Private equity brings structure, scalability, and deep capital. Teams like the Milwaukee Bucks have used PE backing to finance arena renovations and fan tech, while MLS clubs like Real Salt Lake have accelerated their development pipelines with external funding.

But the fan experience is changing. In 2024, the Premier League came under scrutiny when 777 Partners, a Miami-based firm, acquired multiple European clubs, prompting FA investigations into conflicts of interest and fan pushback over ticket hikes and culture loss.

In the U.S., fans face subtler shifts: dynamic ticket pricing, higher merchandise markups, and paywalled regional broadcasts, all aimed at maximizing investor ROI.

The question becomes: who is the team really serving — the hometown crowd or the capital partners?

What This Means for the Future

The next five years may see PE stakes become standard, not optional, across all major U.S. leagues.

Even the NFL, historically the most conservative, is now allowing “institutionalized individuals” to hold passive ownership via approved funds — a quiet shift with loud implications.

The bigger question is whether this new model preserves what makes sports worth investing in: community, loyalty, and unpredictability.

Because when everything is optimized for return… what gets lost in the margin?

(SportAI Inc ™)

Free Fantasy Sports AI Tool

Looking for more rankings and free fantasy tools?

Check out SportAI.io, the all-inclusive fantasy sports app that provides the necessary tools to compare lineups and determine whether to start or bench a player.

SportAI uses its unique Score+ metric, derived from in-house algorithms, to project future fantasy performance relative to other players.

The statistic accounts for performance variance and goes beyond normal benchmarks, using data points such as injuries, team achievement, opponent performance, and more.

Related Reads

Interested in Why the NBA Playoffs Are So Unpredictable? Read here

Want all of the 2025 Fantasy Football Knowledge? Read here

SportAI’s Drop the Mic

“They bought the team. We bought the tickets. Let’s not forget who the game is really for.” — Anonymous fan banner at an AC Milan match

Drop the Mic is a segment that features a funny quote at the end of each blog post!

Connecting With Other Players

Interested in talking with other passionate sports business readers while receiving insightful weekly updates?

Join the SportAI Discord

SportAI

SportAI